Due Diligence Commercial

Commercial Appraisers For Due Diligence

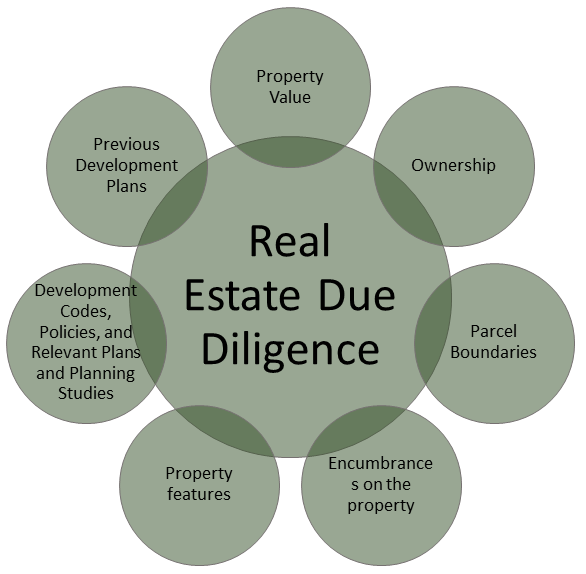

We understand that when engaging in any business transaction, conducting proper due diligence is crucial. That’s why we emphasize the significance of commercial appraisals in the due diligence process.

Imagine embarking on a new venture without knowing the full scope of what lies ahead. It’s like setting sail on uncharted waters without a compass or navigation system – a risky endeavor that could lead to unforeseen challenges and financial pitfalls. By obtaining a professional commercial appraisal, you equip yourself with an invaluable tool that helps navigate these potentially treacherous waters.

When it comes to making informed decisions about buying or selling commercial properties, or making a financial investment in real estate, having a comprehensive understanding of their value and potential risks is essential. Our team of experienced commercial appraisers works diligently to provide you with accurate and reliable appraisal reports to facilitate your due diligence efforts.

With our expert commercial appraisals in hand, you will gain clarity and insight into various aspects such as property value, market trends, potential income streams, and overall risk assessment. This knowledge empowers you to negotiate better deals, secure favorable financing terms, and avoid costly surprises down the road.

Our fast report delivery ensures that you receive the necessary information promptly, allowing you to make well-informed decisions without unnecessary delays. We understand the urgency often associated with due diligence processes, and we aim to expedite our services while maintaining the highest standards of quality. Don’t leave your due diligence process up to chance; trust us to deliver thorough and dependable appraisal reports that will guide your business decisions with confidence.

Why choose us?

– **Accuracy**: Our team of experienced appraisers is dedicated to providing accurate and precise valuations that you can rely on.

– **Timeliness**: We understand that time is of the essence when it comes to due diligence. That’s why we prioritize efficiency and strive to deliver our reports promptly.

– **Professionalism**: With our extensive knowledge and industry experience, you can trust that our appraisers will conduct themselves with utmost professionalism throughout the process.

Due Diligence Commercial Types

- Air BnB's

- Apartment Buildings

- Auto Dealerships

- Bed & Breakfast

- Church & Religious Facility

- Gas Station & Convenience

- Hospitals

- Hotels & Motels

- Industrial Buildings

- Medical Offices

- Mobile Home Parks

- Office Buildings

- Restaurants

- Retail Buildings

- RV Parks

- Self Storage Facility

- Senior Living

- Shopping Centers

- Subdivision Development

- Vacant Land (commercial)

Due Diligence Commercial Uses

- Appraisal Review

- Asset Management

- Condemnation

- Cost Estimation

- Divorce

- Due Diligence

- Eminent Domain

- Estate Settlement

- Financial Planning

- Flood Buyout

- Hard Money Lending

- Investment Analysis

- Listing/Selling

- Litigation Support

- Portfolio Valuation

- Purchase/Buying

- Rent Comparability Study

- Replacement Cost

- Right of Way

- Tax Protest

FAQ to Texas Commercial Appraisals

The most important step to avoiding additional expenses is hiring your Commercial Appraiser directly. DO NOT order from an AMC (appraisal management company) that will add 20-40% on top of the appraiser’s fee. AMC’s often assign the appraisal report to random inexperienced appraisers because they bid lowest. We have competitive appraisal fees because we have eliminated “middlemen” which also reduces report completion times.

Be aware that many of these “management companies” are in other states operated by personnel with NO APPRAISAL EXPERIENCE OR LICENSES. It is important to ask any Appraisal Company about local licensing, qualifications, and experience prior to engaging them for any commercial appraisal assignment. Choose Texas Commercial Appraisals for a competitive fee and local MAI Designated Appraiser!

The MAI designation (Member Appraisal Institute) is highly respected throughout the world as one of the top certifications for commercial appraisers. It requires hundreds of hours of education and training before being granted this title which helps ensure quality services when engaging an appraisal firm or individual for your project. By choosing Texas Commercial Appraisals for your needs, you will gain peace of mind knowing that your property is being handled by experienced professionals who understand both local market conditions as well as national trends.

It is important to ask potential appraisers questions about their qualifications and experience prior to hiring them for a job. It is also wise to ask for references from other clients regarding their level of service and professionalism. By doing this, you can ensure that you are working with an experienced professional who will perform the appraisal accurately and efficiently.

When it comes to the commercial appraisal process in Texas, there are certain expectations for appraisers. They should be familiar with the local market, have a thorough understanding of the property type being appraised and its value, and be willing to communicate their findings clearly. In addition, they should be flexible and willing to work with the client’s needs and timeline.

Appraisers must also adhere to a strict set of ethical standards. This includes providing accurate assessments that are unbiased and free from conflicts of interest. Appraisers must also maintain confidentiality of all information acquired during the appraisal process. Furthermore, they should provide clear written reports that explain their conclusions in detail.

The appraisal process for commercial properties can be a lengthy one, so it’s important to know the industry standard. Depending on the complexity of the property and the appraiser’s schedule, an appraisal should take anywhere from one to four weeks. Furthermore, having all necessary documents ready ahead of time can help speed up the process significantly.

In order to ensure that your appraisal is completed in a timely manner, it’s important to hire an experienced local appraiser who knows the laws governing appraisals in your market area. Working with a qualified professional who understands all aspects of the process is key to getting your appraisal finished quickly and accurately.

The cost of a commercial appraisal can vary depending on the size and complexity of the property being appraised. Generally, the larger and more complex the building or land being appraised, the higher the fee will be. There are other factors that can determine appraisal fees such as intended use of the report, property type, and expedition of services.

On average, a commercial appraisal might range anywhere from $1,500 to many thousands of dollars. Specialized or large-scale assignments can be much more expensive and require several appraisers working simultaneously on multiple reports. You can expect to pay upwards of $10,000 to $50,000 for specialized or large-scale assignments.

Choose TCA for higher quality reports!

MAI Designated General Appraisers in These Zip Codes

77001 • 77002 • 77003 • 77004 • 77005 • 77006 • 77007 • 77008 • 77009 • 77010 • 77011 • 77012 • 77013 • 77014 • 77015 • 77016 • 77017 • 77018 • 77019 • 77020 • 77021 • 77022 • 77023 • 77024 • 77025 • 77026 • 77027 • 77028 • 77029 • 77030 • 77031 • 77032 • 77033 • 77034 • 77037 • 77080 • 77072 • 77073 • 77074 • 77075 • 77076 • 77077 • 77071 • 77079 • 77066 • 77081 • 77082 • 77083 • 77078 • 77070 • 77069 • 77067 • 77065 • 77064 • 77063 • 77062 • 77061 • 77060 • 77059 • 77058 • 77208 • 77084 • 77068 • 77098 • 77213 • 77212 • 77210 • 77209 • 77035 • 77207 • 77057 • 77205 • 77204 • 77203 • 77202 • 77206 • 77099 • 77085 • 77097 • 77096 • 77095 • 77094 • 77093 • 77092 • 77091 • 77090 • 77089 • 77088 • 77087 • 77086 • 77201 • 77015 • 77041 • 77055 • 77054 • 77053 • 77052 • 77051 • 77050 • 77049 • 77048 • 77047 • 77046 • 77045 • 77044 • 77027 • 77042 • 77028 • 77040 • 77039 • 77038 • 77216 • 77036 • 77217 • 77034 • 77033 • 77032 • 77031 • 77030 • 77056 • 77043 • 77267 • 77256 • 77274 • 77273 • 77272 • 77271 • 77270 • 77277 • 77268 • 77279 • 77266 • 77265 • 77263 • 77262 • 77259 • 77257 • 77269 • 77289 • 77215 • 77299 • 77298 • 77297 • 77293 • 77292 • 77275 • 77290 • 77258 • 77288 • 77287 • 77284 • 77282 • 77281 • 77280 • 77291 • 77225 • 77255 • 77233 • 77261 • 77230 • 77229 • 77228 • 77235 • 77226 • 77234 • 77224 • 77223 • 77222 • 77221 • 77220 • 77219 • 77218 • 77227 • 77250 • 77254 • 77253 • 77252 • 77231 • 77251 • 77236 • 77249 • 77248 • 77245 • 77244 • 77243 • 77242 • 77241 • 77240 • 77238 • 77237

Local Commercial Appraisers in Your Neighborhood

Acres Homes • Alden Bridge • Alief • Allendale • Astrodome • Belle Court • Binz • Braeburn • Braesview Terrace • Braeswood Place • Briar Forest • Briar Meadow • Central Southwest • Clear Lake • Clinton Park • Cochran's Crossing • College Court Place • College Park • Colonial Terrace • Creekside Park • Cunningham Terrace • Dorado • Downtown • East End • East Houston • East Little York • Eastwood • Edgebrook • Eldridge • Fairbanks • Fifth Ward • Fondren Gardens • Fondren Park • Fondren Southwest • Fonmeadow • Forth Ward • Garden Oaks • George Bush International Airport • Golfcrest • Greater Heights • Greater Hobby • Greater Inwood • Greenspoint • Grogan's Mill • Gulfgate • Gulfton • Harrisburg • Herman Park • Hidden Valley • Houston Heights • Huntwood • Independence Heights • Jensen • Kashmere Gardens • Langwood • Lazy Brook • Macgregor • Magnolia Park • Medical Center • Memorial • Memorial Park • Midtown • Minnetex • Monticello • Montrose • Museum District • Myerland • Neartown • North Shore • Northside • Northside Village • Panther Creek • Park Place • Park Ten • Pecan Park • Pemberton • Pleasantville • Port Houston • Research Forest • Rice Court • Rice Village • Richmond Plaza • River Oaks • Second Ward • Settegast • Sharpstown • South Acres • South Main • South Main Gardens • South Park • South Union • Southbelt • Spring • Spring Branch • Spring Branch Central • Spring Branch East • Spring Branch West • Spring Shadows • Sterling Ridge • Sunnyside • Sunset Terrace • The Villages • Third Ward • Trinity • University Place • Upper Kirby • Uptown • Virginia Court • Washington Ave. • Wayside • West University Place • Westbury • Westchase • Westwood • Willow Bend

Commercial Appraisals for these Houston Market Areas

Aldine • Alvin • Atascocita • Bayou Vista • Baytown • Beach City • Bellaire • Bellville • Brazos Country • Brookshire • Brookside Village • Bunker Hill Village • Channelview • Cinco Ranch • Clear Lake Shores • Cleveland • Cloverleaf • Crosby • Cut and Shoot • Dayton • Deer Park • East Houston • El Lago • Four Corners • Fresno • Friendswood • Fulshear • Galena Park • Greatwood • Greenspoint • Hedwig Village • Hilshire Village • Hitchcock • Hockley • Huffman • Humble • Hunters Creek Village • Jacinto City • Jersey Village • Katy • Kemah • Kingwood • La Porte • League City • Liberty • Liverpool • Magnolia • Manvel • Meadows Place • Mission Bend • Missouri City • Mont Belvieu • Montgomery • Morgan's Point • Nassau Bay • New Territory • Northshore • North Houston • Oak Ridge North • Pasadena • Pattison • Patton Village • Pearland • Pecan Grove • Piney Point Village • Plum Grove • Porter • Richmond • Rosenberg • Santa Fe • Seabrook • Sealy • Shenandoah • Shoreacres • Sienna Plantation • Simonton • South Houston • Southside Place • Splendora • Spring Valley Village • Sheldon • Spring • Stafford • Sugar Land • Taylor Lake Village • Texas City • The Woodlands • Tomball • Wallis • Webster • Westlake • West Columbia • West University Place • Woodbranch

Previous Client Reviews!

D. Napier

“I’ve used Texas Commercial Appraisals several times for commercial appraisals in the Houston and Dallas areas. I chose them initially because they are competitively priced with great turn times. I continue to use them because their service is top notch.”

R. Brice

“We recently used Texas Commercial Appraisals to appraise a property we have owned over 15 years. This was by far the best Commercial Appraisal and hands down the best service. They respond quickly to calls or emails and the Appraiser Greg did a thorough appraisal and took the time to discuss details. I definitely would recommend this company to anyone considering a commercial appraisal in Austin or anywhere they service!”

F. Robbins

“I needed an appraisal one of our properties in the Memorial area. Our Appraiser was professional, courteous, thorough, and helpful. The Appraisal Report that was provided following his appraisal was complete and showed significant attention to detail. Seriously, I only wish we had found them sooner...”

G. Matthews

“I was in a serious time crunch and this company was able to schedule the site visit within 48 hours. Our Appraiser was exemplary and the report arrived two weeks later as promised! We exclusively recommend Texas Commercial Appraisals to other investors we know.”

J. Nguyen

"I recently had an apartment complex appraised, the appraiser showed up on time, was professional and conducted a thorough walk through. The report took about 3 weeks but, it was very thorough and spot on! I am very happy with the appraiser and the report.”

J. Martinez

“I was looking to get a Hard-Money loan to renovate and complete additions to my office warehouse. My Lender recommended Texas Commercial Appraisals and thank God they did. The loan funded weeks after the report was delivered, I was impressed!”

T. Washington

“Texas Commercial Appraisals came out on short notice to appraise an investment property I was in the process of purchasing. I found them online and not through my lender. I wanted an independent appraiser since the lender was connected to my broker. They were professional and knowledgeable in all matters. Definitely will use them again and recommend to associates, Thank You!